Today, smartphones are ubiquitous.

An estimated 85% of people in North America, and 57% of people around the world, reported having access to mobile internet in 2022. That represents a meteoric rise from 2015, when only 58% of North Americans and 35% of the world said the same.

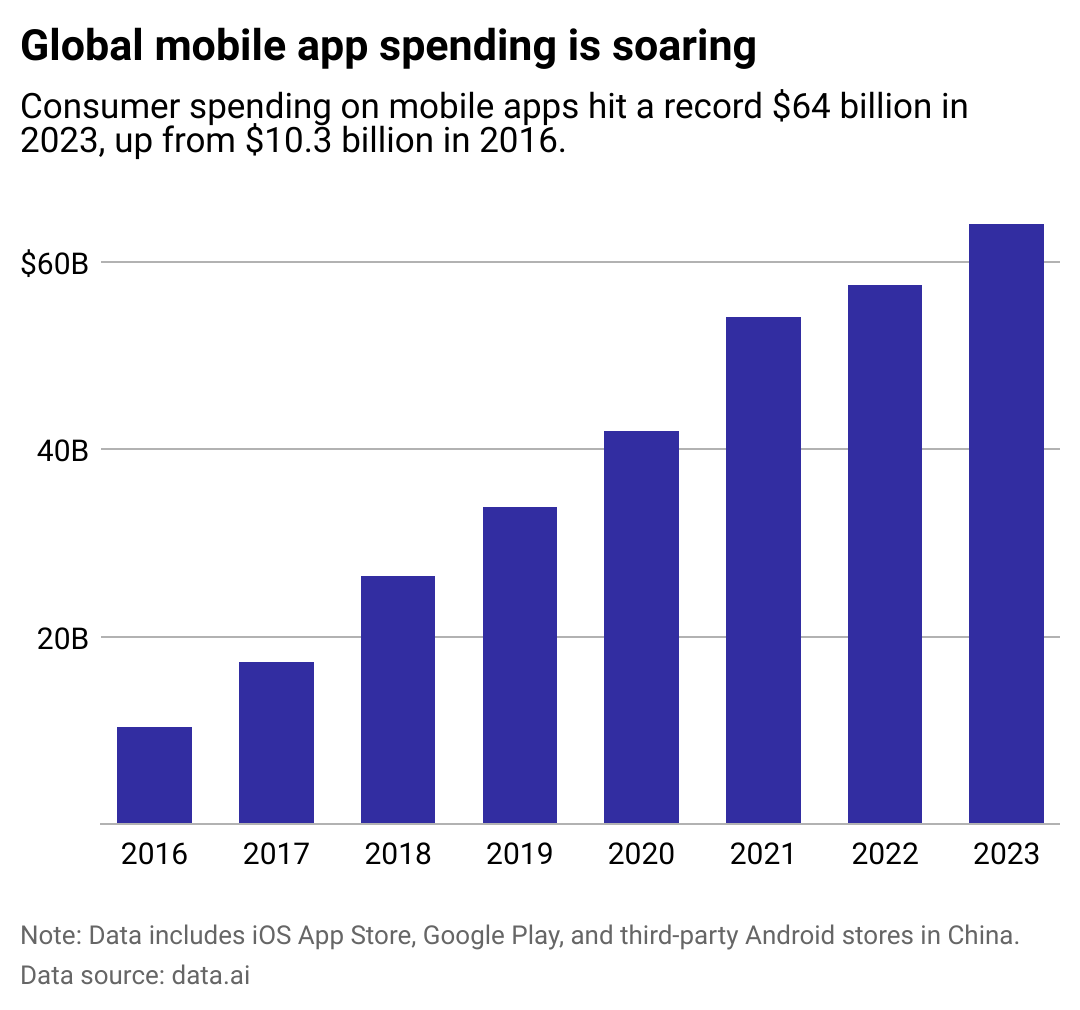

Making apps for this burgeoning market is a lucrative business. Flippa analyzed research from data.ai to see how this market is evolving. The data shows that consumer spending on mobile apps has skyrocketed from $10.3 billion in 2016 to an impressive $64 billion in 2023.

Initially, the iPhone did not support third-party apps, expecting that users would do everything through "web apps" (basically webpages) or their browser. But in 2008, Apple changed its mind and launched the iOS App Store, revolutionizing the mobile landscape. This move has proven to be incredibly profitable for the company. According to its latest annual report, "services" income, which includes money it makes through its App Store, now accounts for more than 20% of its total net sales. Similarly, marketplaces like Google Play Store dominate the Android market.

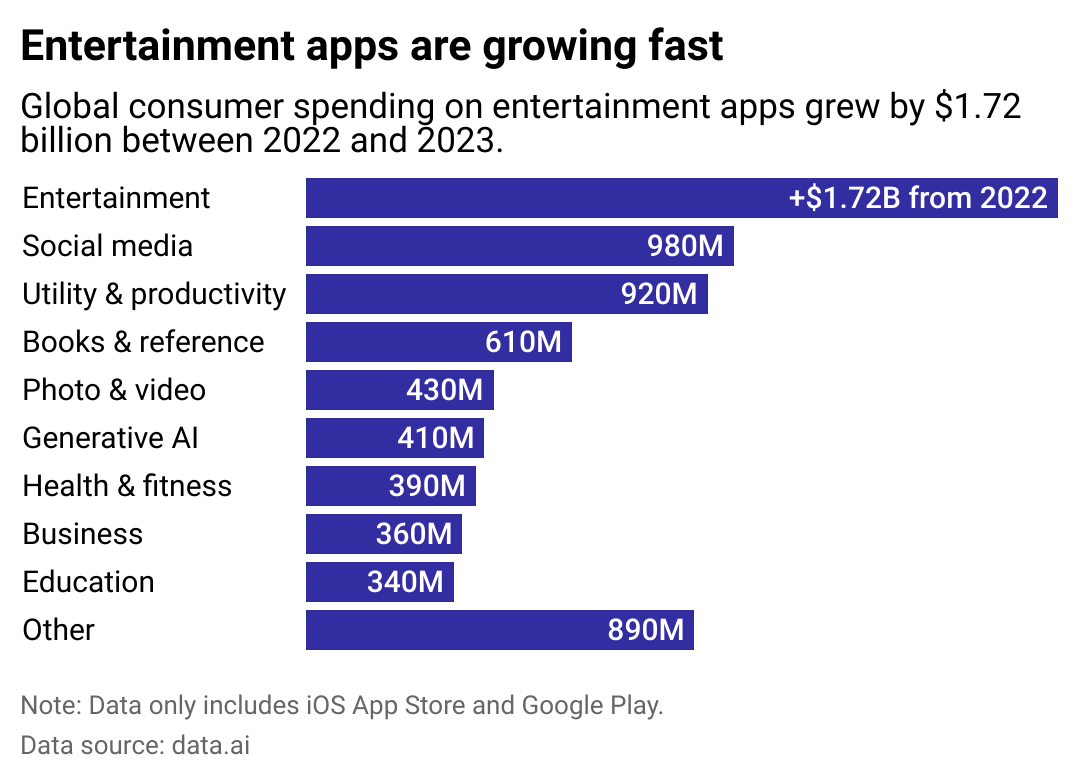

Between 2022 and 2023, the fastest-growing segment in nongaming mobile revenue was entertainment apps, including social and streaming platforms such as TikTok and Spotify. This category accounted for more than a quarter of the $6.5 billion increase in mobile app revenue last year. Utility and productivity apps, such as virtual private network services, made for the biggest increase in downloads, followed by shopping platforms. Consumers rely on their mobile devices for an increasing proportion of their daily lives.

Consumer spending on mobile games has been fairly consistent since the COVID-19 pandemic, grossing $107 billion in 2023, up slightly from $101 billion in 2020. "Hypercasual games," however, which offer quick gameplay sessions, have been emerging as a major growth driver. By focusing on simplicity, games like Thief Puzzle or Attack Hole have captured massive audiences.

In general, social media and communications tools dominate the mobile app space. Four apps developed by Meta sit at the top of the rankings. Facebook has the most monthly active users out of any app, followed by WhatsApp, Instagram, and Messenger. TikTok, the most popular app not produced by Meta, saw explosive growth in 2023, leading the way in downloads. The only nonsocial app to make the list of the top 10 most downloaded apps was CapCut, a video editing tool developed by ByteDance, the same company behind TikTok.

TikTok has been praised by many because of its recommendation algorithm, which seems unusually effective at matching users with content they want to see. But as data.ai's report details, it is also unusually good at monetization. TikTok became the first app to hit $10 billion in all-time in-app revenue last year, beating out the Tinder and YouTube mobile apps (each of which earned around $8 billion to date). Most consumer spending on TikTok comes from its payments system, which allows users to tip their favorite content creators with small payments.

Many channels on platforms such as TikTok and YouTube have become businesses in their own right. Some people are now buying and selling accounts, capitalizing after creators have already established an audience.

While TikTok has made several innovations in how content creators run their businesses, the app has government officials concerned. Policymakers worry that the app, owned by a Chinese company, presents data security risks—not to mention a dangerously high influence over American consumers. The Biden administration signed a bill on April 24 that could ban TikTok or force ByteDance to sell the app. The CEO of TikTok vowed to challenge the ban in the courts.

As consumers increasingly turn to their phones first for all their lifestyle needs, even existing businesses—many of which now operate primarily as mobile apps or get most of their revenue as accounts on major social media and video-sharing platforms—will have to adapt to keep up.

Story editing by Nicole Caldwell. Copy editing by Paris Close. Photo selection by Clarese Moller.

This story originally appeared on Flippa and was produced and distributed in partnership with Stacker Studio.